Operating a service bureau in California requires adherence to both federal IRS regulations and state-specific requirements. EROs (Electronic Return Originators) managing service bureau operations face unique compliance challenges that demand systematic operational procedures.

This guide outlines five essential steps to maintain compliance while operating efficiently in California's regulatory environment.

Step 1: Establish EFIN Authorization Structure

Service bureau operations begin with proper EFIN (Electronic Filing Identification Number) authorization. California EROs must maintain clear documentation of all preparers using their EFIN infrastructure.

Create a verification system that tracks:

- Current PTIN status for all preparers

- Active e-file authorization from the IRS

- California tax preparer registration numbers

- Expiration dates for all credentials

Implement a quarterly review process. Check preparer credentials before each filing season begins. Remove access immediately when preparers leave your organization or fail to maintain required credentials.

Document every preparer's relationship to your service bureau. Maintain signed Form 8879 authorizations and engagement letters. California requires additional state-level documentation for preparers who submit returns through your infrastructure.

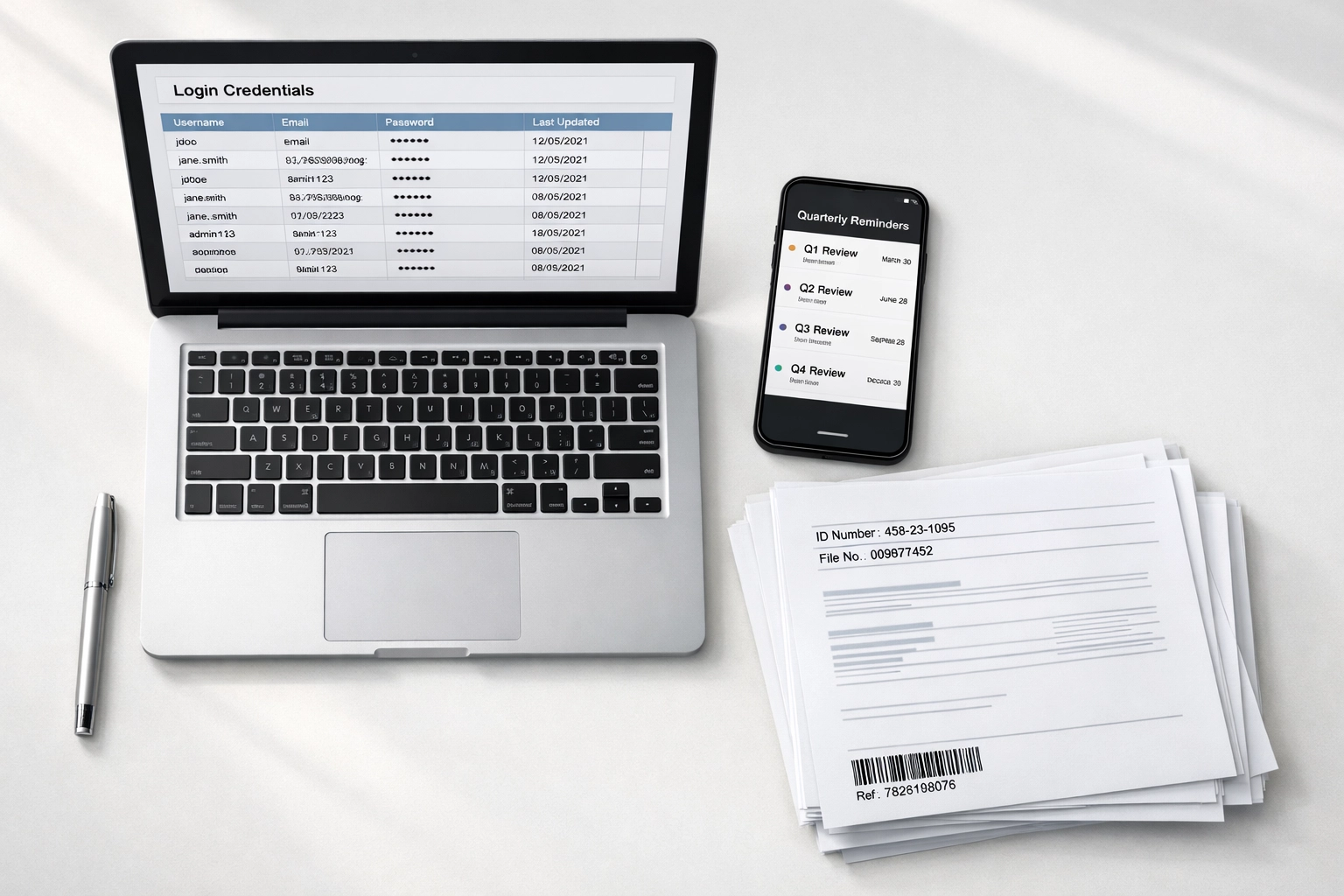

Step 2: Implement State-Compliant Data Security Protocols

California's data protection requirements exceed federal standards. The California Consumer Privacy Act (CCPA) and related regulations impose specific obligations on service bureaus handling taxpayer information.

Your security protocols must address:

- Encryption standards for data at rest and in transit

- Access controls limiting who views taxpayer data

- Breach notification procedures meeting California timelines

- Record retention compliant with both IRS and state requirements

California law requires notification of data breaches within specific timeframes. Develop an incident response plan before you need it. Identify legal counsel familiar with California breach notification requirements.

Conduct annual security audits. Document your security measures in writing. California regulatory authorities may request evidence of compliance during investigations.

Third-party vendor agreements require specific language. Ensure contracts with software providers and cloud storage services address California's data residency and protection requirements.

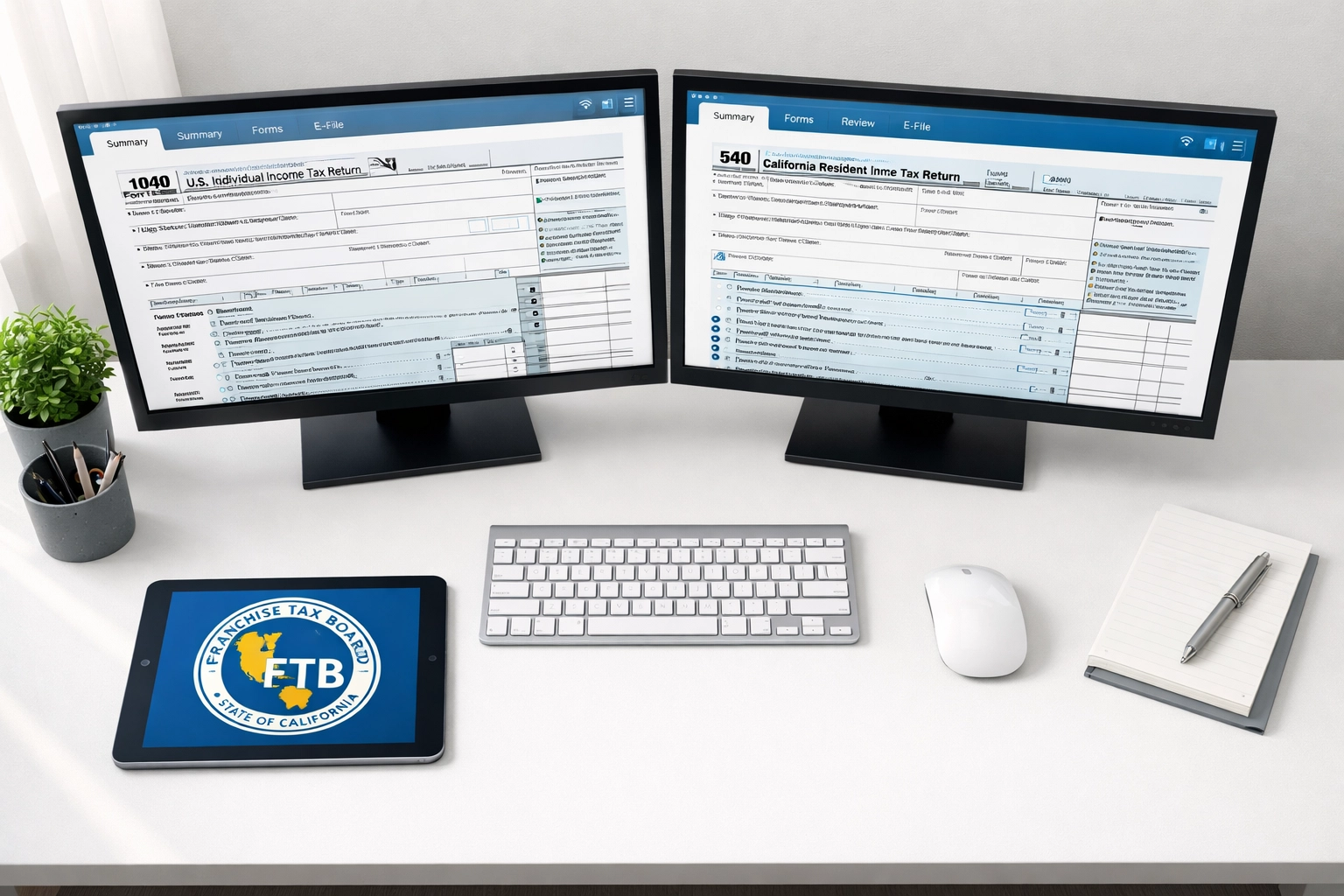

Step 3: Configure California FTB E-File System Integration

The California Franchise Tax Board (FTB) operates a separate e-file system from the IRS. Service bureaus must configure their systems to handle both federal and state submissions correctly.

Register your service bureau directly with the FTB. Obtain separate California e-file credentials. Do not assume federal IRS authorization automatically covers California state returns.

Test your FTB e-file connectivity before filing season. Submit test returns through the California system. Verify acknowledgment processing works correctly for both accepted and rejected returns.

Configure your tax software to handle California-specific requirements:

- California state identification numbers

- Nonresident and part-year resident calculations

- California-specific credits and adjustments

- Mental Health Services Tax for high-income filers

Monitor California legislative changes. The FTB updates e-file specifications annually. Subscribe to FTB notifications for tax professionals to receive technical updates.

Step 4: Develop Service Bureau Client Onboarding Procedures

Service bureau clients require structured onboarding to ensure compliance. Develop written procedures for adding new tax preparation firms to your platform.

Your onboarding checklist must include:

- IRS e-file application status verification

- California tax preparer registration confirmation

- Signed service bureau agreement

- Fee structure documentation

- Training completion records

California requires specific disclosures when operating as a service bureau. Document that preparers understand their responsibilities when using your EFIN. Clarify that each preparer remains responsible for return accuracy regardless of using service bureau infrastructure.

Provide written procedures to clients. Explain submission deadlines, acknowledgment retrieval processes, and rejected return protocols. Document that clients understand their obligation to maintain their own preparer credentials.

Implement a probationary period for new clients. Monitor their first 10-20 returns closely. Identify preparation quality issues early before they create compliance problems.

Step 5: Establish Audit Trail and Record Retention Systems

California service bureaus must maintain comprehensive records demonstrating compliance. Build systems that automatically create audit trails for all activities.

Required documentation includes:

- Every return transmitted through your EFIN

- All Form 8879 electronic signatures

- Preparer authorization records

- System access logs

- Client communications regarding return status

California law requires specific record retention periods. Maintain return records for a minimum of four years. Some documentation types require longer retention.

Configure your practice management software to track retention requirements automatically. Set automated reminders for document destruction after retention periods expire. Do not retain taxpayer data indefinitely: excessive retention creates unnecessary data breach risk.

Create searchable indexes of retained records. California regulatory investigations may require producing specific documentation quickly. Organize records to allow rapid retrieval when needed.

Implement secure destruction procedures for expired records. California law requires secure disposal methods for taxpayer information. Document your destruction process and maintain destruction logs.

California-Specific Compliance Considerations

California imposes additional requirements beyond federal ERO obligations. Service bureaus must register with the California Tax Education Council (CTEC) if providing services to CTEC-registered tax preparers.

Monitor California's tax preparer consent requirements. The state mandates specific authorization language for preparers to disclose taxpayer information. Service bureau agreements must address these consent requirements.

California law restricts certain business practices for tax preparers. Refund anticipation loans face regulatory constraints. Ensure your service bureau agreement prohibits clients from using your infrastructure for non-compliant products.

The FTB conducts compliance audits of service bureaus. Maintain records demonstrating adherence to all regulations. Document your quality control procedures and preparer verification processes.

Infrastructure Requirements for California Operations

Service bureau operations demand reliable technical infrastructure. California's large tax preparation market generates significant e-file volume during peak periods.

Your infrastructure must handle:

- Simultaneous submissions from multiple preparers

- Federal and California state return batching

- Acknowledgment processing during high-volume periods

- Rejected return resubmission workflows

Test your systems under load conditions before filing season. Verify your infrastructure scales appropriately for peak demand. California's filing deadlines create concentrated submission periods that stress inadequate systems.

Establish backup procedures for system failures. Maintain relationships with alternative transmission providers. Document contingency plans for infrastructure outages during critical filing periods.

Monitor IRS and FTB system availability. Both agencies publish planned maintenance schedules. Communicate system downtime to clients before it affects their operations.

Ongoing Compliance Maintenance

California ERO compliance requires continuous attention throughout the year. Establish quarterly review procedures to maintain compliant operations.

Schedule regular reviews of:

- Preparer credential status

- Software version updates

- Security protocol effectiveness

- Client agreement currency

- Record retention compliance

Subscribe to professional organization updates. California tax law changes frequently. Stay informed about new requirements affecting service bureau operations.

Conduct annual training for staff managing service bureau operations. Document training completion. Ensure everyone involved in bureau management understands current compliance requirements.

Maintain professional liability insurance appropriate for service bureau operations. Coverage requirements differ from individual preparer policies. Verify your policy addresses service bureau-specific risks.

Operating a compliant service bureau in California requires systematic procedures and ongoing vigilance. These five steps provide the foundation for efficient, compliant operations that serve tax preparation professionals effectively.