SEO Title: Scale Your Service Bureau Without Hiring Extra Staff

Slug: scale-service-bureau-operations-without-staff

Excerpt: Learn proven strategies to increase service bureau capacity using automation, standardized workflows, and strategic client selection without adding headcount.

Tags: Service Bureau, ERO Operations, Tax Business Growth, Automation, Workflow Management

Capacity Constraints in Service Bureau Operations

Service bureau operations face predictable bottlenecks during tax season. Return volume increases while staff capacity remains fixed. Traditional responses involve hiring temporary workers or refusing new clients. Both options limit revenue growth.

Scaling without additional headcount requires systematic changes to how work flows through your operation. Focus shifts from labor hours to process efficiency.

Automate Return Intake and Data Validation

Manual data entry consumes significant staff time. Implement automated intake systems that capture client information directly from tax preparers.

Configure validation rules that reject incomplete returns before staff review. Common errors include missing W-2s, unsigned forms, and incorrect Social Security numbers. Automated checks catch these issues immediately.

Set up pre-submission checklists that preparers complete before transmission. This shifts quality control upstream, reducing your team's correction workload. Each prevented error saves 10-15 minutes of staff time.

API integrations with major tax software platforms eliminate manual file transfers. Returns flow directly into your processing queue without human intervention.

Standardize Transmission Workflows

Create uniform procedures for every return type. Document exact steps from receipt to IRS transmission. Include timing requirements, approval thresholds, and escalation protocols.

Build processing templates for common scenarios:

- Simple wage earners with standard deductions

- Self-employed filers with Schedule C

- Returns requiring state submissions

- Amended returns and prior-year filings

Each template specifies required documents, validation steps, and transmission timing. Staff execute the same sequence regardless of individual return complexity.

Assign returns to staff based on template category rather than client relationship. This enables specialization and reduces decision fatigue.

Implement Tiered Service Pricing

Structure pricing based on return complexity and turnaround time. Standard processing at 48 hours carries base pricing. Express service at 24 hours commands premium rates. Same-day processing requires highest fees.

This pricing model naturally segments clients by urgency. Price-sensitive preparers submit earlier in the week. Premium clients pay for priority processing during peak periods.

Revenue per return increases without additional processing time. Staff capacity allocates efficiently across the week rather than concentrating at deadlines.

Communicate clear submission cutoff times. Returns received after daily cutoff process next business day. This prevents last-minute volume spikes that overwhelm staff.

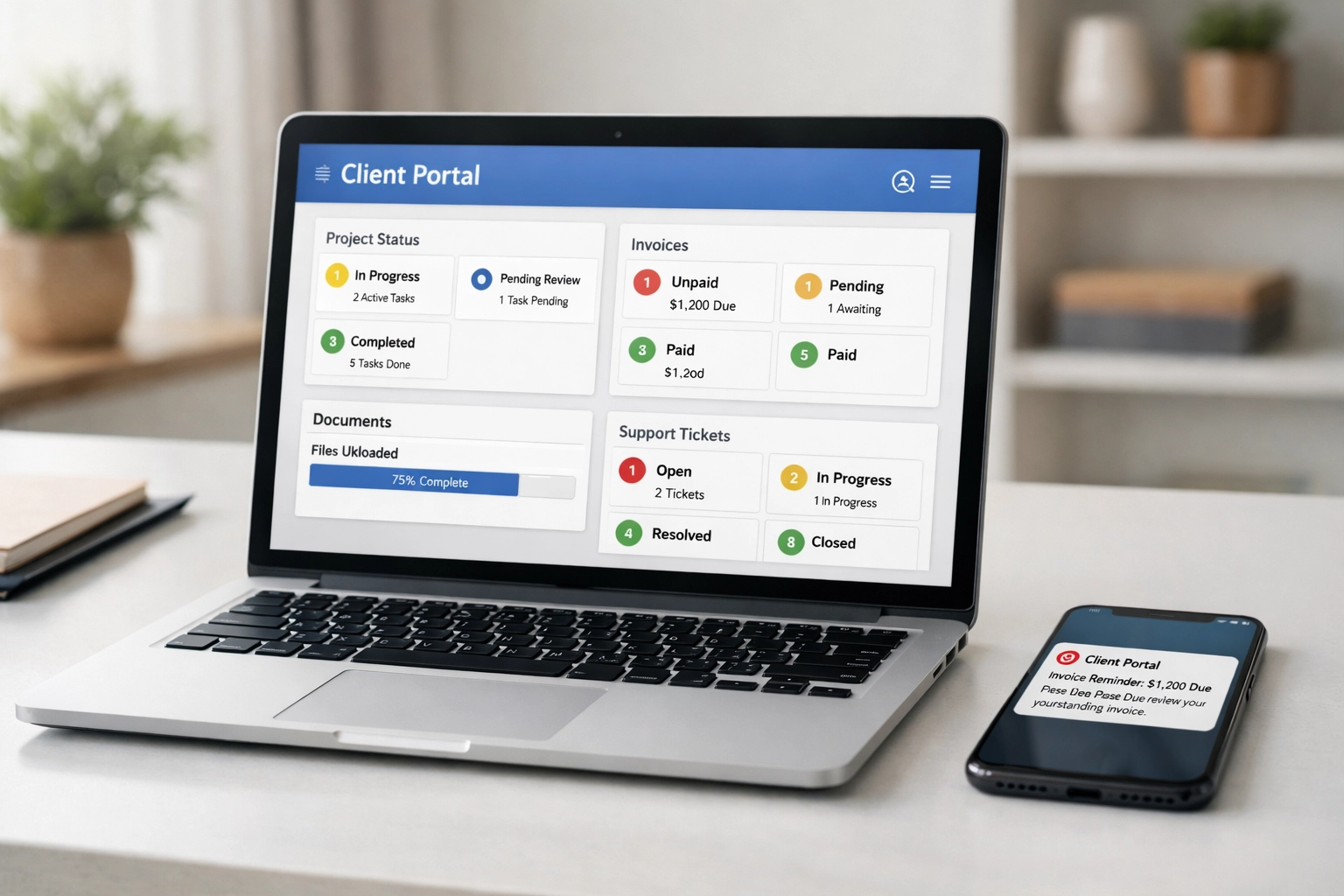

Deploy Self-Service Status Portals

Build client portals that display return status in real-time. Preparers check transmission status, acknowledgment receipt, and rejection notices without contacting support staff.

Automated email notifications reduce inbound inquiries:

- Confirmation upon return receipt

- Notification of IRS acceptance

- Alert for rejections with error codes

- Final confirmation of refund approval

Each automated notification prevents 3-5 support contacts. During peak season, this reclaims hours of staff capacity daily.

Include FAQ sections addressing common questions about transmission timing, rejection codes, and IRS processing delays. Preparers resolve routine issues independently.

Optimize Reject Resolution Processes

IRS rejections require immediate attention but follow predictable patterns. Create decision trees for the 20 most common reject codes.

For each code, document:

- Exact cause of rejection

- Required corrective action

- Responsibility assignment (preparer vs. service bureau)

- Resubmission timeline

Configure automated responses that route rejects to appropriate staff members based on error type. Simple corrections flow to junior staff. Complex issues escalate to senior processors.

Measure reject rates by preparer. Identify frequent offenders and provide targeted training. Reducing reject rates from 8% to 5% significantly decreases rework volume.

Select Clients Strategically

Not all service bureau clients generate equal value. Evaluate preparers based on:

- Average returns per season

- Reject rate history

- Payment reliability

- Support request frequency

Establish minimum volume requirements for new clients. Turn away preparers submitting fewer than 50 returns annually. Focus capacity on higher-volume relationships.

Implement graduated fee structures that reward volume. Preparers submitting 200+ returns receive lower per-return rates. This incentivizes existing clients to grow rather than adding new small-volume accounts.

Review client roster annually. Exit relationships with chronic problem accounts that consume disproportionate support resources.

Leverage Batch Processing Windows

Configure systems to process returns in scheduled batches rather than continuous individual submissions. Batch processing reduces system overhead and enables parallel workflows.

Establish batch windows:

- Morning batch: 7:00 AM – processes overnight submissions

- Midday batch: 1:00 PM – handles morning intake

- Evening batch: 7:00 PM – clears afternoon volume

- Overnight batch: 11:00 PM – final daily processing

Staff focus on preparation during gaps between batches. This creates uninterrupted work periods that increase processing speed.

Communicate batch schedules to clients. Set expectations that returns submitted after cutoff process in next window. This manages urgency while maintaining workflow efficiency.

Track Performance Metrics

Monitor operational metrics that indicate capacity utilization:

- Returns processed per staff hour

- Average time from receipt to transmission

- Reject rate by processor and client

- Support tickets per 100 returns

- Revenue per staff member

Establish baseline measurements at season start. Set improvement targets for each metric. Review weekly during peak season.

Identify efficiency gains through metric comparison. A 10% reduction in processing time per return increases capacity by 50+ returns weekly with existing staff.

Build Process Documentation Libraries

Document every procedure in searchable knowledge base. Include screen captures, step-by-step instructions, and troubleshooting guides.

New staff onboard faster with comprehensive documentation. Seasonal workers reach productivity in days rather than weeks.

Update documentation after each tax season. Incorporate lessons learned and process improvements. This continuous refinement increases efficiency year over year.

Cross-train staff on multiple functions. Documentation enables quick transitions between tasks based on daily workflow demands.

Implement Quality Assurance Sampling

Conduct spot checks on 5-10% of transmitted returns. Random sampling catches systematic errors before they affect large volumes.

Create quality checklists covering:

- Correct return type selection

- Accurate bank account information

- Proper state submission handling

- Complete signature documentation

Address identified issues immediately through targeted staff training. This prevents error patterns from compounding.

Technology Stack Requirements

Service bureau scaling requires specific technical infrastructure:

Return Management System: Tracks returns from intake through final acceptance. Provides status visibility and workflow automation.

Secure File Transfer: Encrypted transmission between preparers and service bureau. Automated validation and virus scanning.

Communication Platform: Bulk email capabilities for status updates and notices. Integration with return management system.

Analytics Dashboard: Real-time visibility into processing volume, staff utilization, and bottleneck identification.

Backup Systems: Redundant processing capability prevents single points of failure during peak periods.

Investment in technology infrastructure generates immediate capacity gains. Systems operate continuously without fatigue or errors.

Manage Seasonal Volume Fluctuations

Tax season creates extreme volume variation. January processes 3x December volume. April handles 5x January volume.

Structure operations to absorb peaks without proportional staff increases:

- Cross-train administrative staff for processing duties

- Establish relationships with contract processors for extreme peaks

- Implement volume caps with existing clients during final week

- Adjust batch frequencies during high-volume periods

Communicate capacity limits transparently. Set client expectations about processing timelines during April 10-15 period.

Revenue Impact

Operational improvements translate directly to financial performance. Processing 15% more returns with existing staff increases revenue $75,000-150,000 annually for mid-size service bureaus.

Reduced reject rates save $5-10 per return in rework costs. Automated support reduces labor expenses 20-30%.

Premium pricing for express service generates 30-40% margin improvement on 15-20% of volume.

Scaling capacity without headcount increases profit margins while expanding market share.