SEO Title: Scale Your ERO Practice Without Hiring More Staff

Slug: scale-ero-practice-without-hiring-staff

Excerpt: Learn five proven strategies to grow your ERO practice capacity without adding full-time employees. Streamline operations and increase revenue efficiently.

Tags: ERO Operations, Tax Business Growth, Service Bureau, Practice Management, Tax Software, Workflow Automation

Electronic Return Originators face a common challenge during tax season: increasing client volume without proportionally increasing staff costs. Traditional scaling methods require hiring preparers, tax professionals, and support staff. This approach increases overhead and complicates management.

Alternative methods exist for scaling ERO operations. These strategies focus on process optimization, technology implementation, and strategic partnerships. The following five steps provide actionable approaches to expand capacity while maintaining quality standards.

Step 1: Partner with a Service Bureau for EFIN Support

Service bureaus offer infrastructure support without requiring EROs to maintain their own EFIN. This arrangement eliminates technical overhead and allows focus on client relationships and preparation work.

Service bureau partnerships provide:

- IRS transmission services

- Software hosting and updates

- Technical support and troubleshooting

- Compliance monitoring

- Bank product coordination

For Ohio EROs, service bureau partnerships address specific state requirements while maintaining federal compliance. Ohio requires Commercial Tax Preparers to register with the Ohio Department of Taxation. Service bureaus handle technical compliance while EROs manage client-facing operations.

Implementation requires:

- Research service bureau options and fee structures

- Review transmission success rates and support availability

- Verify software compatibility with current systems

- Complete onboarding and integration process

- Test transmission procedures before peak season

Service bureaus process returns on behalf of EROs. This model allows practices to handle higher volume without investing in expensive software licenses, servers, or technical staff.

Step 2: Automate Client Intake and Document Collection

Manual document collection creates bottlenecks. Paper-based intake processes require physical handling, data entry, and follow-up communications. Digital intake systems reduce preparation time by 40-60%.

Implement automated intake through:

- Secure client portals for document upload

- Digital questionnaires with conditional logic

- Electronic signature capture

- Automated reminder systems

- Integration with tax preparation software

Automated systems verify document completeness before preparation begins. This reduces back-and-forth communication and preparation delays. Client portals allow 24/7 document submission, extending effective business hours without staff presence.

For practices serving Ohio clients, automated systems must accommodate state-specific forms including Ohio IT 1040 and school district requirements. Configure intake questionnaires to capture Ohio residency information, municipal tax jurisdictions, and credits specific to Ohio taxpayers.

Digital intake reduces physical storage requirements. Electronic document management provides faster retrieval during IRS inquiries or amended return preparation.

Step 3: Standardize Preparation Workflows and Quality Control

Inconsistent processes create inefficiencies. Standardized workflows reduce preparation time and minimize errors. Document each process step to eliminate decision-making delays.

Create standardized procedures for:

- Initial document review and organization

- Data entry sequence and verification

- Common deduction and credit applications

- Review and quality control checkpoints

- Client communication protocols

Implement checklists for each return type. Simple individual returns require different workflows than complex business returns. Separate procedures prevent unnecessary steps and reduce completion time.

Quality control procedures prevent costly errors. Establish review protocols based on return complexity and preparer experience. Multi-tier review systems catch errors before transmission while maintaining efficiency.

Template libraries reduce redundant work. Develop templates for common client letters, engagement agreements, and tax planning recommendations. Standardized templates maintain consistency while reducing drafting time.

Step 4: Leverage Tax Software Integrations and Automation

Modern tax software includes automation features that many EROs underutilize. Advanced features reduce manual data entry and calculation time.

Key automation features include:

- Prior year data import

- Bank statement transaction categorization

- Automatic form population from source documents

- Error detection and resolution suggestions

- Multi-state return coordination

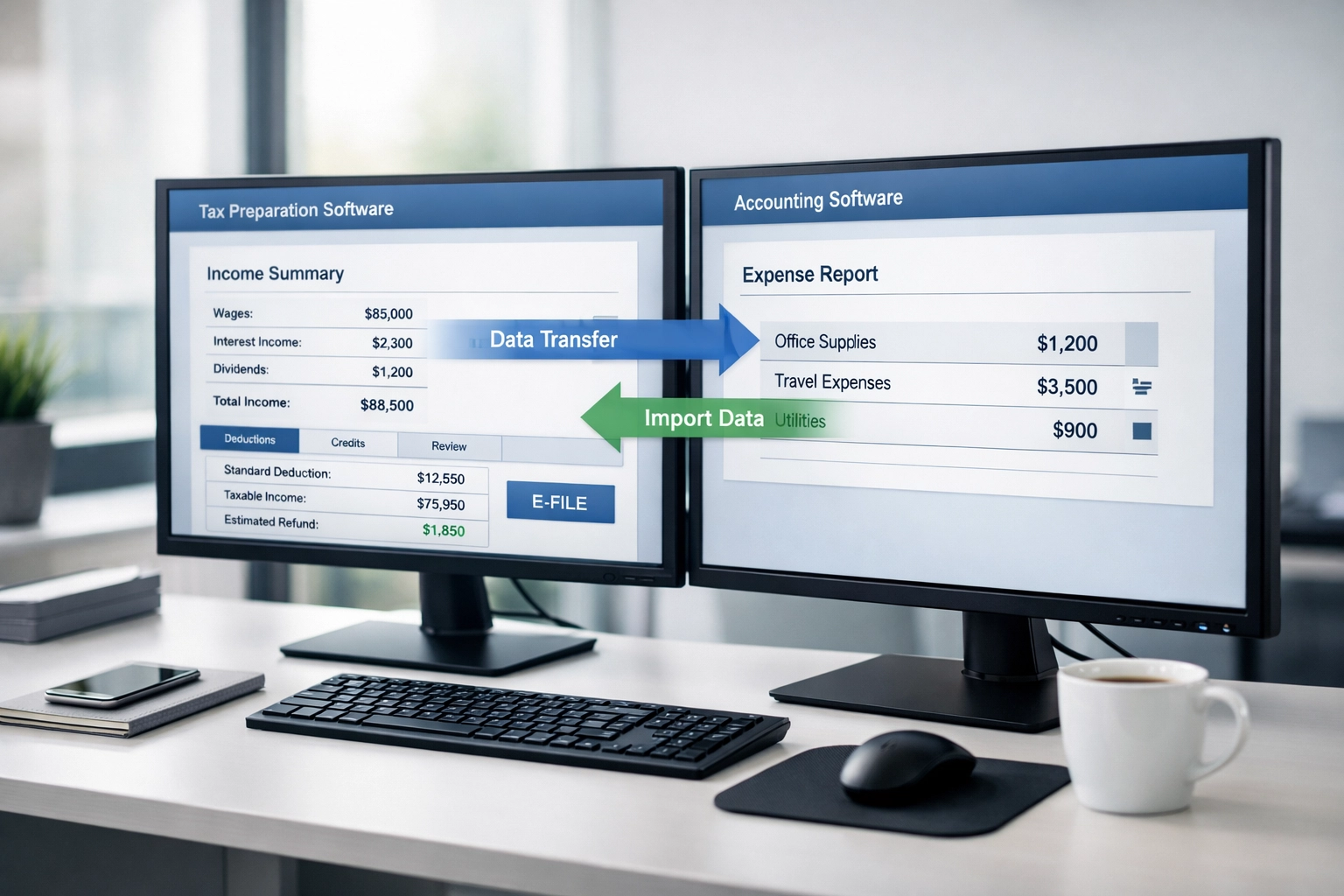

Software integrations connect tax preparation systems with:

- Document management platforms

- Client relationship management tools

- Accounting software for business clients

- Practice management systems

- Electronic payment processors

For Ohio practices, ensure software properly calculates Ohio municipal taxes. Ohio has over 600 municipalities with varying tax rates and regulations. Software must correctly identify taxpayer residency and work locations to calculate proper municipal tax obligations.

Configure software shortcuts for frequent operations. Custom hotkeys and macros reduce repetitive tasks. Investment in software training produces measurable efficiency gains. Most tax software providers offer advanced training beyond basic operation.

API integrations automate data transfer between systems. Eliminate manual data re-entry by connecting client portals, tax software, and document management systems. Integration reduces errors and accelerates processing time.

Step 5: Outsource Specialized Functions and Peak Season Overflow

Strategic outsourcing addresses capacity constraints without permanent staff additions. Identify functions requiring specialized expertise or creating seasonal bottlenecks.

Functions suitable for outsourcing include:

- Complex business return preparation

- Multi-state tax return coordination

- Amended return research and preparation

- Audit representation and correspondence

- Peak season overflow processing

Offshore preparation services provide cost-effective capacity expansion. India-based tax preparation firms offer qualified preparers at reduced rates. Overnight preparation allows next-day delivery to clients. Quality control remains in-house to maintain standards.

Virtual tax professional networks connect EROs with licensed preparers on contract basis. Establish relationships before tax season to ensure availability during peak periods. Contract preparers handle overflow while internal staff focuses on complex returns and client relationships.

For Ohio-specific work, ensure outsourced preparers understand Ohio tax law nuances. Ohio's school district taxes, municipal tax reciprocity agreements, and unique credits require specialized knowledge. Provide training materials and reference guides to external preparers.

Bookkeeping and accounting functions separate from tax preparation. Many ERO practices combine services. Outsourcing bookkeeping allows staff focus on higher-value tax preparation and planning services.

Implementation Timeline

Execute these steps over 90-120 days before peak tax season:

Days 1-30: Research and select service bureau partner. Evaluate software automation features and identify integration opportunities.

Days 31-60: Implement automated client intake system. Document current workflows and create standardized procedures.

Days 61-90: Configure software integrations and templates. Establish relationships with outsourcing providers.

Days 91-120: Train staff on new systems and procedures. Test workflows with sample returns before production processing.

Incremental implementation reduces disruption. Complete foundational changes before addressing advanced optimization.

Measuring Results

Track key performance indicators to measure scaling success:

- Returns per staff member per season

- Average preparation time per return type

- Client acquisition cost

- Revenue per employee

- Error and rejection rates

- Client satisfaction scores

Ohio EROs should track municipal tax calculation accuracy separately. Municipal tax errors trigger penalties and damage client relationships.

Establish baseline metrics before implementing changes. Compare performance across tax seasons to measure improvement. Adjust processes based on data rather than assumptions.

Annual capacity increases of 25-40% are achievable without staff additions. Combined implementation of all five steps produces compounding benefits. Practices report doubling capacity over two seasons while maintaining quality standards.

Conclusion

ERO practice scaling requires strategic process changes rather than proportional staff increases. Service bureau partnerships, automation, standardization, software optimization, and selective outsourcing provide viable alternatives to traditional hiring models.

Implementation demands upfront investment in systems and procedures. Returns appear within one tax season through increased capacity and reduced operational costs. Practices achieve sustainable growth while maintaining service quality and client relationships.