The tax preparation industry has quietly undergone a massive transformation. While many firms still rely on manual processes, forward-thinking professionals have discovered AI automation tools that deliver remarkable results. Here's what the most successful tax preparers are actually doing in 2026.

Document Processing Revolution: From Hours to Seconds

Manual data entry consumes 50+ hours per week for most tax practices. AI-powered optical character recognition (OCR) systems now extract, categorize, and structure data from W-2s, 1099s, and receipts in seconds.

These systems use machine learning to recognize tax forms instantly. Upload a stack of documents, and the AI identifies each form type, extracts relevant fields, and organizes everything into your tax software automatically.

Implementation tip: Start with high-volume forms like W-2s and 1099s. These standardized documents deliver the fastest accuracy improvements and time savings.

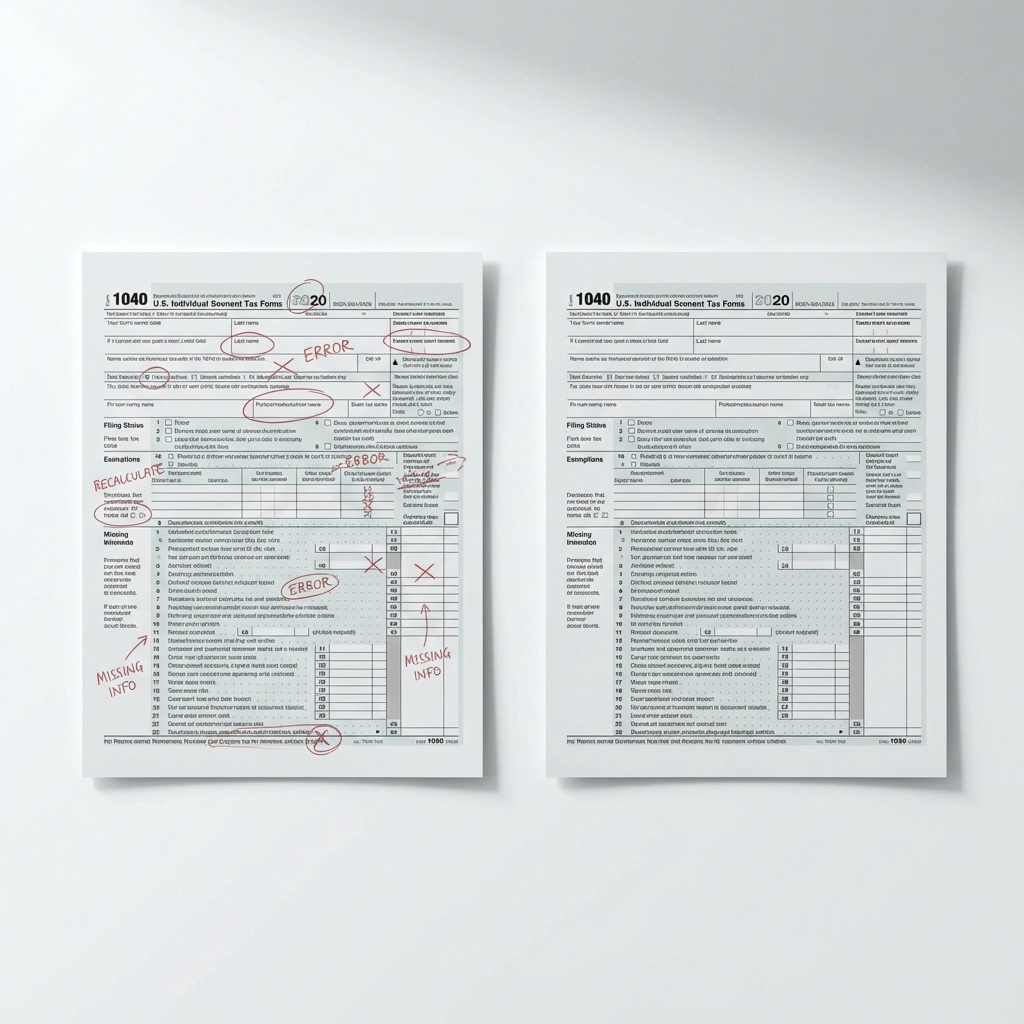

Error Detection That Beats Human Experts

AI-powered tax systems achieve error rates below 1% for e-filed returns compared to 21% for manual paper processing. The technology detects discrepancies humans miss: wrong entries, duplicate records, outdated tax codes, and overlooked deductions.

Advanced AI systems cross-reference client data against current tax codes, flagging potential issues before submission. They identify missing forms, inconsistent information, and optimization opportunities in real-time.

Implementation tip: Configure your AI system to flag common error patterns specific to your client base. Small businesses often have different error patterns than individual filers.

Predictive Tax Planning Changes Everything

Traditional tax preparation is reactive – clients bring documents at deadline, preparers file returns, repeat next year. AI enables proactive tax strategy throughout the year.

Predictive systems analyze client financial patterns, identifying tax optimization opportunities months before filing season. They recommend deduction strategies, suggest timing for major expenses, and calculate projected liabilities with remarkable accuracy.

Implementation tip: Use predictive analysis to offer year-round advisory services. This transforms one-time clients into ongoing relationships while increasing revenue per client.

Seamless Platform Integration Eliminates Double Work

Modern AI tax systems connect directly with accounting platforms like QuickBooks, Xero, and SAP. Extracted data flows automatically without additional manual entry or file transfers.

This integration eliminates the time-consuming process of switching between systems, reducing errors from manual transfers and keeping all client information synchronized.

Implementation tip: Choose AI solutions that integrate with your existing software stack. Avoid systems that require complete platform changes unless the benefits justify the transition costs.

What Leading Firms Use Right Now

Thomson Reuters, Kintsugi, and Parseur offer commercial AI solutions specifically designed for tax professionals. These aren't experimental tools – they're production-ready systems handling millions of returns.

These platforms provide:

- Real-time document processing

- Automated compliance monitoring

- Error detection and correction

- Direct integration with major tax software

- Client communication tools

Implementation tip: Request trials from multiple providers. Test accuracy with your actual client documents before committing to any platform.

Cost Reduction Strategies

AI automation reduces operational costs through:

Staff optimization: Redirect manual data entry staff to client service and advisory roles rather than eliminating positions.

Overhead reduction: Process more returns with existing infrastructure rather than expanding office space or equipment.

Error prevention: Avoid costly amendments and IRS correspondence through improved accuracy.

Implementation tip: Calculate ROI based on time savings and error reduction, not just direct cost comparison with current software.

Security Enhancement Through Automation

AI systems improve data security by reducing human handling of sensitive information. Automated processing minimizes the number of people accessing client data and creates detailed audit trails.

Advanced platforms encrypt data throughout the processing pipeline and provide role-based access controls. They track every interaction with client information, meeting compliance requirements more effectively than manual systems.

Implementation tip: Verify that AI platforms meet SOC 2 Type II requirements and provide compliance documentation for your practice.

Client Experience Transformation

Automated systems enable faster turnarounds and more accurate returns, improving client satisfaction. Real-time status updates and automated communication keep clients informed throughout the process.

Many AI platforms include client portals where individuals can upload documents, track progress, and access completed returns securely.

Implementation tip: Use automation to provide better service rather than just faster processing. Clients value accuracy and communication over speed alone.

Implementation Roadmap for Small and Mid-Sized Firms

Phase 1: Start with document processing automation for your highest-volume form types. This provides immediate time savings and accuracy improvements.

Phase 2: Add error detection and compliance checking to reduce amendment rates and IRS correspondence.

Phase 3: Implement predictive planning tools to expand service offerings beyond basic preparation.

Phase 4: Integrate client communication and portal systems to improve the overall experience.

Implementation tip: Don't attempt to automate everything simultaneously. Gradual implementation allows staff training and process refinement without disrupting operations.

Measuring Success

Track these metrics to evaluate AI automation effectiveness:

- Time per return completion

- Error and amendment rates

- Client satisfaction scores

- Revenue per client

- Staff utilization rates

Implementation tip: Establish baseline measurements before implementing AI systems. Document improvements to justify continued investment and guide future decisions.

Looking Ahead

79% of accounting professionals expect AI tools to drive practice growth in 2026. Firms that adopt automation early gain competitive advantages through improved efficiency, accuracy, and client service.

The technology continues advancing rapidly. Current AI systems represent the foundation for even more sophisticated capabilities coming in the next few years.

Implementation tip: Choose scalable platforms that regularly update features rather than static solutions that may become outdated quickly.

AI automation is transforming tax preparation from manual, error-prone processes into streamlined, accurate systems. Small and mid-sized firms can access the same technology that large practices use, leveling the competitive playing field.

The question isn't whether to adopt AI automation – it's how quickly you can implement these tools to serve clients better and grow your practice.