The tax preparation landscape has transformed dramatically over the past few years. While many tax professionals still rely on outdated Electronic Return Originator (ERO) methods from the early 2010s, smart practitioners are leveraging modern service bureau support to streamline operations and maximize profitability.

If you're still struggling with slow filing processes, complicated IRS EFIN applications, or limited client capacity, it's time to modernize your approach. Today's ERO services offer sophisticated solutions that can revolutionize how you handle electronic filing: without the traditional overhead and compliance burdens.

The Problem with Traditional ERO Methods

Most tax preparers learned ERO processes when the system was clunky and limited. Traditional methods required extensive paperwork, lengthy IRS approval processes, and significant upfront investments in software and infrastructure. Many professionals spent months obtaining their own EFIN, only to discover maintenance requirements that consumed valuable time during peak season.

These outdated approaches typically involved:

- Manual form submissions to the IRS

- Complex software installations requiring IT support

- Limited filing capacity during high-volume periods

- Extensive record-keeping for compliance audits

- Higher operational costs due to infrastructure requirements

Modern Service Bureau Advantages

Today's service bureau support systems operate differently. Cloud-based platforms, automated compliance monitoring, and streamlined approval processes have eliminated most traditional barriers. Professional ERO services now offer immediate access to electronic filing capabilities without the traditional investment or administrative burden.

The shift toward service bureau solutions provides tax preparers with enterprise-level capabilities typically reserved for large firms. Small and medium practices can now access the same filing infrastructure, compliance support, and technical resources that previously required significant capital investment.

7 Quick Service Bureau Hacks for 2026

1. Leverage Multi-Platform Integration

Modern ERO services integrate seamlessly across multiple tax software platforms. Instead of limiting yourself to single-vendor solutions, configure your service bureau to work with different software packages simultaneously.

This approach allows you to:

- Handle complex returns requiring specialized software

- Accommodate client preferences for specific platforms

- Maintain backup systems during software updates

- Access competitive pricing across different vendors

Set up test environments with 2-3 different tax software options through your service bureau provider. This redundancy ensures continuous operation even when one platform experiences downtime.

2. Automate Client Communication Workflows

Service bureau platforms now include sophisticated client communication tools that automatically send status updates, filing confirmations, and refund tracking information.

Configure automated workflows that:

- Send immediate confirmation when returns are received

- Provide real-time filing status updates

- Notify clients of refund deposit dates

- Alert about any IRS correspondence or issues

Most service bureau providers offer customizable email templates and SMS integration. Spend time setting up these automated sequences early in the season to reduce manual communication tasks later.

3. Utilize Bulk Processing Features

High-volume periods become manageable when you properly configure bulk processing capabilities. Modern ERO services support batch submissions that can handle hundreds of returns simultaneously.

Optimize bulk processing by:

- Grouping returns by complexity level

- Scheduling submissions during off-peak hours

- Using automated error checking before batch submission

- Setting up priority queues for time-sensitive returns

Configure bulk processing rules that automatically sort returns based on factors like refund amounts, complexity scores, or client priority levels.

4. Implement Advanced Error Prevention

Service bureau systems include sophisticated error detection that identifies potential issues before submission to the IRS. These tools catch problems that traditional software might miss.

Modern error prevention features include:

- Real-time validation against current tax law changes

- Cross-reference checking for mathematical errors

- Automatic formatting corrections for common mistakes

- Proactive alerts for missing required documentation

Enable all available error checking options and configure alerts to notify you immediately when potential issues are detected. This prevents costly rejects and reduces processing delays.

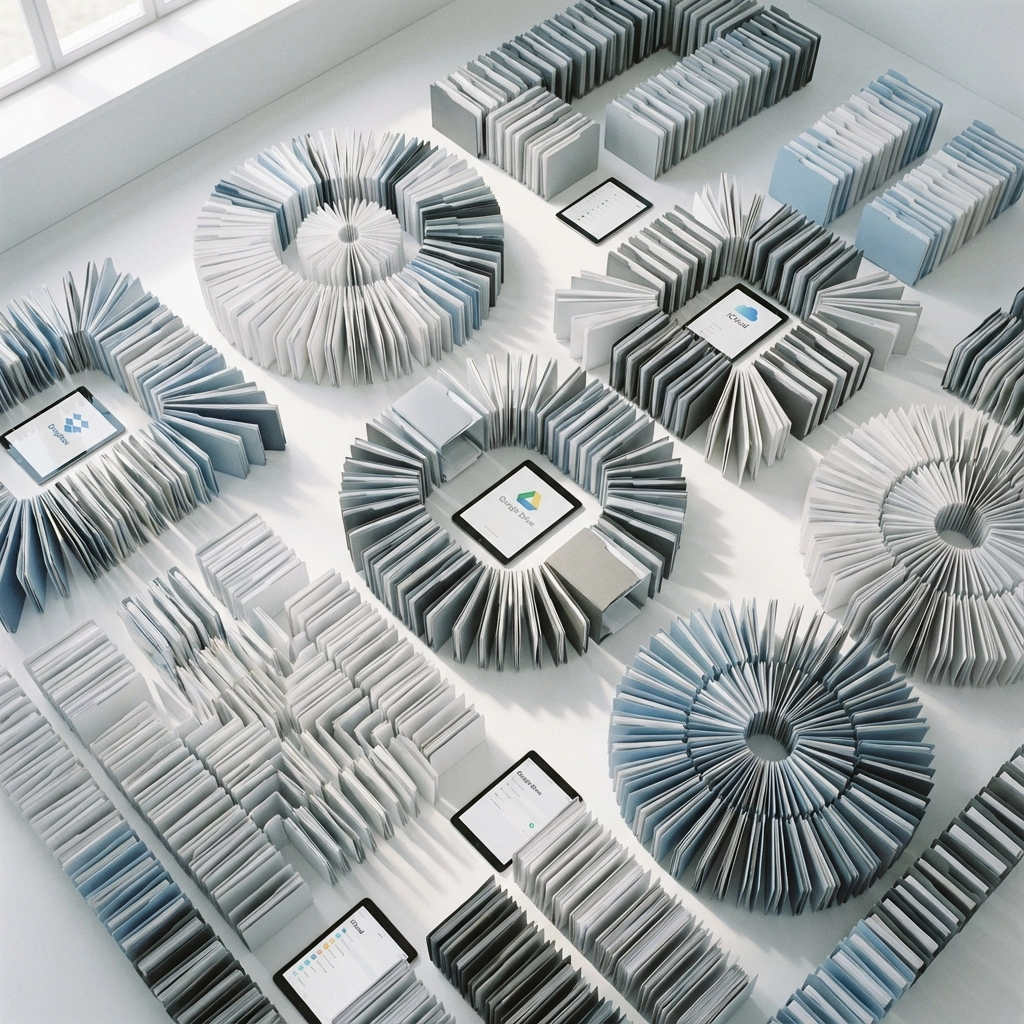

5. Maximize Cloud-Based Storage Integration

Today's ERO services integrate directly with cloud storage platforms, enabling seamless document management and client access. This eliminates the traditional paper filing systems and local storage requirements.

Set up cloud integration to:

- Automatically organize returns by year and client

- Provide secure client portals for document access

- Enable remote work capabilities for staff

- Maintain automatic backups of all filing data

Configure folder structures that align with your existing workflow processes. Most service bureau providers support integration with popular platforms like Google Drive, Dropbox, or Microsoft OneDrive.

6. Leverage Real-Time Analytics and Reporting

Modern service bureau platforms provide detailed analytics that help optimize operations and identify growth opportunities. These insights were previously unavailable to smaller practices.

Use analytics to track:

- Filing volume trends throughout the season

- Average processing times by return type

- Client satisfaction scores and feedback

- Revenue optimization opportunities

Set up automated reports that deliver key metrics weekly during peak season and monthly during off-peak periods. This data helps inform staffing decisions, pricing strategies, and service improvements.

7. Configure Multi-State Filing Optimization

Service bureau support now handles complex multi-state filing requirements automatically. Instead of managing separate state filing processes, configure your system to handle all jurisdictions through a single platform.

Multi-state optimization includes:

- Automatic state filing fee calculations

- Jurisdiction-specific form selection

- Compliance monitoring across different state requirements

- Consolidated reporting for multi-state clients

Enable automatic state detection based on client information and configure default settings for common multi-state scenarios. This reduces manual intervention and minimizes errors.

Implementation Timeline

Begin implementing these hacks immediately, starting with the automated workflows and error prevention features. These provide immediate benefits and require minimal setup time.

Focus on one hack per week during your slow season, allowing time to properly configure and test each feature. By peak season, all systems should be operational and staff should be trained on the new processes.

Choosing the Right Service Bureau Provider

Not all ERO services offer the same capabilities. Evaluate providers based on their support for modern integration features, automation capabilities, and scalability options.

Key selection criteria include:

- Cloud-based architecture with mobile access

- Integration with multiple tax software platforms

- Comprehensive error checking and prevention tools

- Automated client communication features

- Transparent pricing without hidden fees

Cost-Benefit Analysis

While service bureau support involves ongoing fees, the operational savings typically exceed costs within the first season. Reduced administrative overhead, elimination of software maintenance, and increased filing capacity provide significant return on investment.

Most practices see 20-30% efficiency improvements and can handle 40-50% more clients without additional staff when properly leveraging modern ERO services.

The tax preparation industry continues evolving rapidly. Practices that embrace modern service bureau capabilities position themselves for sustained growth while those relying on outdated ERO methods face increasing operational challenges.

These seven hacks represent proven strategies that successful practices use to maximize service bureau benefits. Implementation requires initial time investment but delivers significant long-term advantages in efficiency, capacity, and profitability.

Start with automated workflows and error prevention features, then gradually implement additional capabilities as your team becomes comfortable with the new processes. By next season, these modern ERO methods will become standard operating procedures that drive practice growth and client satisfaction.